Economic numbers continue to point to a soft landing

Bank of Canada Governor Tiff Macklem responds to a question during a news conference following an interest rate announcement, Wednesday, October 25, 2023 in Ottawa. THE CANADIAN PRESS/Adrian Wyld

Canada’s economy had a stronger end to 2023 than many expected, with GDP data this week showing activity rising 0.2 per cent in November and 0.3 per cent in December.

That puts growth in the fourth quarter solidly in positive territory, effectively ending a stall that lasted for much of the middle part of last year. To add perspective to the numbers, Canada’s economy grew more in the last two months of 2023 than it did the previous nine months from February to October.

We'll get final comprehensive fourth-quarter numbers at the end of February, with the caveat that the monthly data is prone to revisions. But the much warned-about recession is still nowhere to be seen in the data.

SOURCE: STATISTICS CANADA

It could go one of two ways from here. This may turn out to be just a blip and momentum will dissipate. Or the economy will continue to surprise on the upside as it has over the past year. There’s also the issue of rapid population growth, which is making it difficult to gauge underlying strength.

Still, it’s clearly positive news. The numbers continue to point to a soft landing.

Just a reminder that growth has been slowing materially since 2021, when the economy expanded at a pace of more than five per cent in the aftermath of the pandemic. Even with the stronger-than-expected pickup in November and December, growth probably averaged about 1.5 per cent in 2023, down from 3.9 per cent in 2022. The consensus for 2024 is at about 0.5 per cent, effectively a stall but no major downturn.

Tricky politics

This is all net positive for Prime Minister Justin Trudeau’s government, obviously. No one wants a recession. And while the jobless rate has risen, there doesn’t appear to be a lot of pain in the labour market, for most workers at least. Not yet.

But the governing Liberals should also temper expectations of what a political win looks like in this scenario.

The flip side to surprise resiliency in the economy is that it raises questions around the persistence of inflation.

The Bank of Canada is actually trying to engineer a little bit of economic weakness to ease price pressures. Should that not materialize, expect Canada’s interest rate profile to be higher for longer.

It will lessen the case for the Bank of Canada to cut interest rates any time soon and this will disappoint many Canadians holding on to a lot of debt.

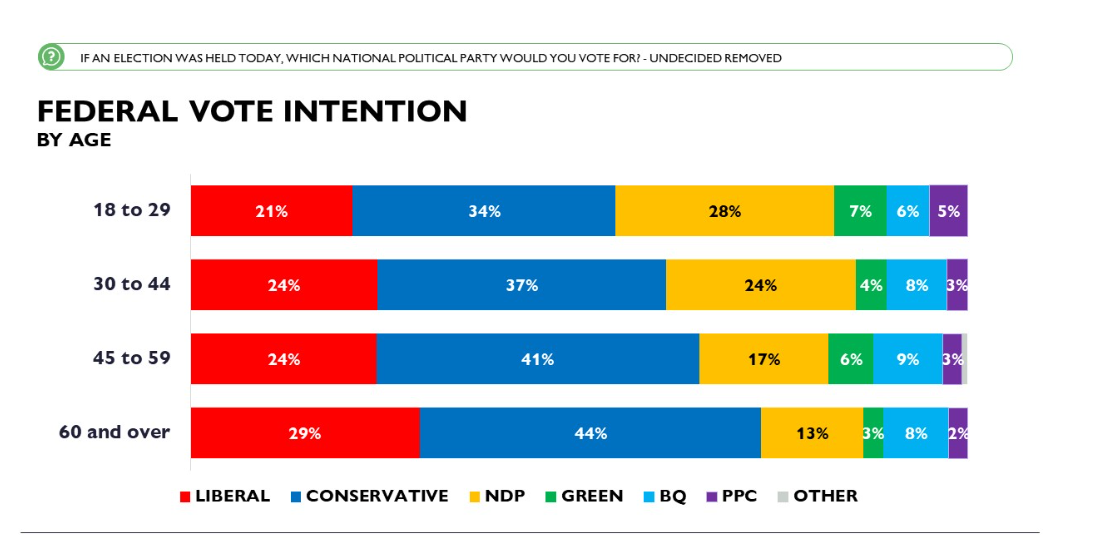

ABACUS DATA

While inflation hits everyone across the board, higher interest rates create winners and losers. The big losers are young and lower-income Canadians who tend to rely more on credit. The winners are older Canadians with plenty of home equity and savings.

This won’t help the Liberals’ lagging support among young voters, where they trail both the Conservatives and the NDP, as the latest poll from Abacus Data shows.

Pausing, not cutting

Central bankers across the globe have been pushing back on expectations of imminent interest rate cuts. The latest pushback came from the U.S. Federal Reserve this week, when the world’s most important central bank left its benchmark rate unchanged at a target range of 5.25-5.5 per cent.

“We’re not declaring victory at all,” Federal Reserve Chair Jerome Powell told reporters on Jan. 31.

Paul Beaudry, a former member of the Bank of Canada’s decision-making council, said in an interview posted on CIBC’s website that he doesn’t expect a rate cut until July. Markets are pricing in a cut in Canada as early as June.

There are some economists warning there’s still a risk that rates could even rise further. Scotiabank’s Derek Holt is one of them. He believes that risk is being fuelled by continued wage growth, which he described in a Jan. 31 report as inflationary and unsustainable.

Recent wage settlements show an acceleration in union wage demands.

According to the latest collective bargaining data from the Canadian government, annual wage settlements averaged 4.5 per cent between July and October and more than double the pre-pandemic pace. Unions have been emboldened by a combination of tight labour markets, aging demographics and inflation and they are prepared to walk off the job for higher wages.

In his report, Holt illustrated just how disruptive the recent wave of strikes has been. He found the number of hours lost to strike has actually surpassed the losses during the pandemic closures.